Analyze creditworthiness and customer profiles with verified data

CreditCheck analyzes verified financial data from your applicants' banks through Open Banking technology. We process income, spending patterns, and payment behavior to deliver clear creditworthiness assessments and customer profiles for smarter approval decisions and risk management.

WHY CREDITCHECK

Self-reported financials can be misleading. Bank data doesn't lie.

Applications and forms rely on what people tell you: stated income, employment status, financial commitments. These can be exaggerated, outdated, or simply incorrect.

Without access to verified financial data, your company risks:

- Approving applicants with inflated income claims or inadequate payment capacity

- Missing critical red flags hidden in self-reported information

- Rejecting creditworthy customers with incomplete credit histories

- Manual verification processes that slow decisions and increase operational costs

CreditCheck uses Open Banking technology to retrieve verified financial data from applicants' banks.

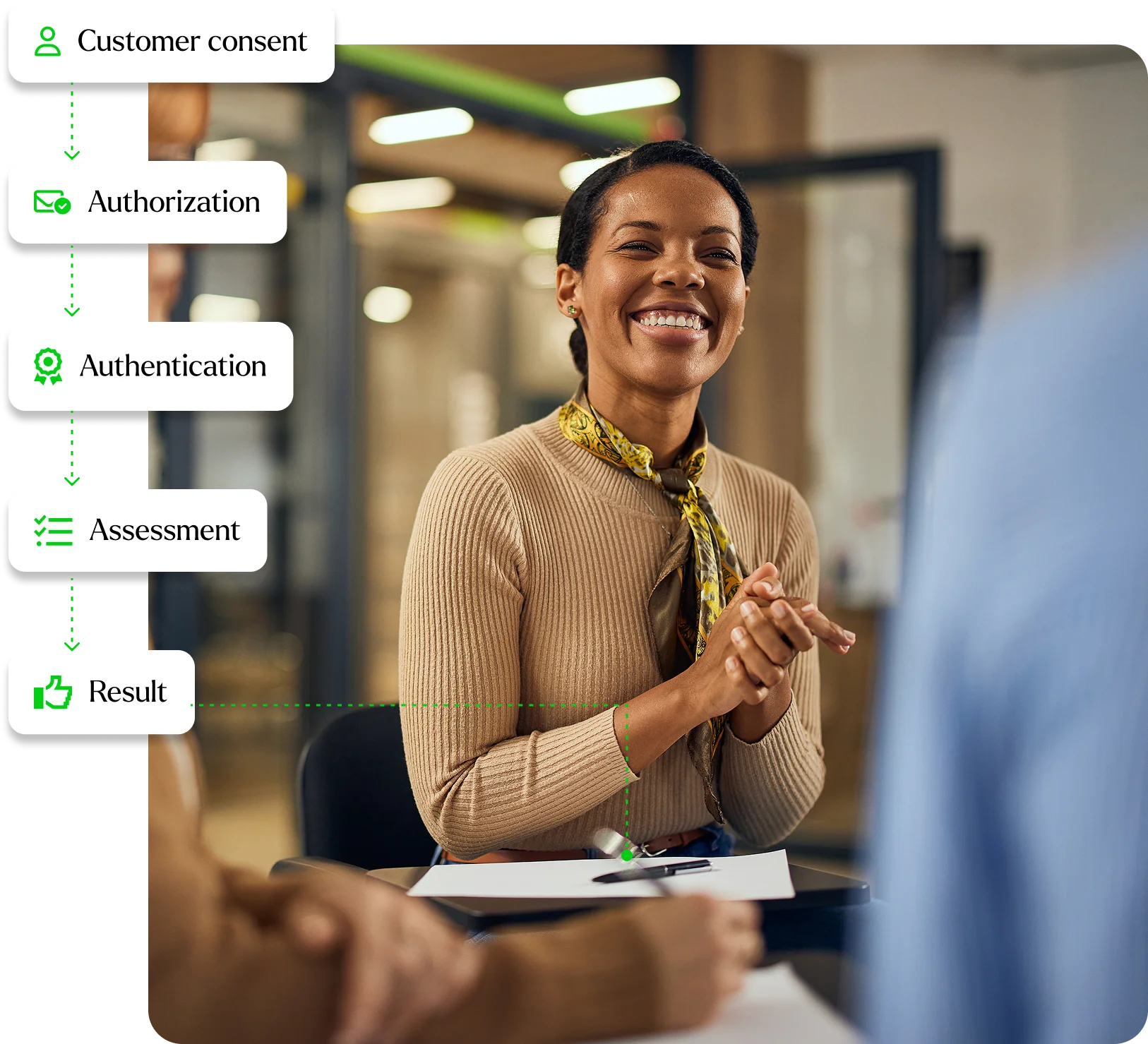

HOW IT WORKS

How CreditCheck retrieves verified bank data

Applicant consents during your application process

The applicant provides consent for CreditCheck to access their financial data via Open Banking.

CreditCheck sends a secure authorization link

The applicant receives an email with a unique link to authorize their bank to share transaction data through the Open Banking flow.

The applicant authenticates with their bank

The link opens a regulated Open Banking flow where the applicant authorizes their bank to share their transaction report. CreditCheck receives verified account data in a read-only way.

CreditCheck analyzes verified data and returns assessment and profile

CreditCheck processes the verified banking data and returns a clear creditworthiness assessment.

WHO IS IT FOR

For any business that needs to assess financial risk or understand customer capacity

CreditCheck is designed for companies that:

- Need to evaluate creditworthiness with verified data before approving applications or contracts

- Want to profile customers based on actual verified financial behavior

Common use cases include:

- Rental and leasing decisions: Verify tenant or lessee income and financial stability with real bank data

- Consumer financing and BNPL: Approve customers based on verified payment capacity to profile customers based on actual verified financial behavior

- Subscription and service businesses: Confirm ability to sustain recurring payments

- B2B credit terms: Verify business client financial health before extending payment terms

- Customer segmentation: Tailor offerings and terms based on verified financial profiles

- Upsell opportunities: Identify customers with verified capacity for premium products

High-volume IBAN verification for utility companies and staffing agencies.

IBANcheck is priced based on verification volume and adapted to the specifics of each business.

Get in touch if you have any questions or would like to receive a pricing proposal.