Verify payment details before processing transactions

IBANcheck adds an IBAN verification step to your onboarding so you can be sure every IBAN is valid and belongs to the right person before you install, activate a service, or run payroll.

WHY IBANCHECK

Onboarding is costly. A wrong IBAN turns it into a loss.

Every new customer or worker costs money to onboard: acquisition, checks, setup, activation, admin time...

If the IBAN is incorrect, or doesn't belong to the person you onboarded, your company risks:

- Losing onboarding, setup and early service or payroll costs

- Having first payments or salary transfers fail

- Spending extra back-office time fixing account issues and disputes

IBANcheck helps you catch IBAN and ownership issues before they become lost revenue.

HOW IT WORKS

How IBANcheck fits into your onboarding flow

IBAN is collected during your onboarding process

The user enters their IBAN as usual in your form or system.

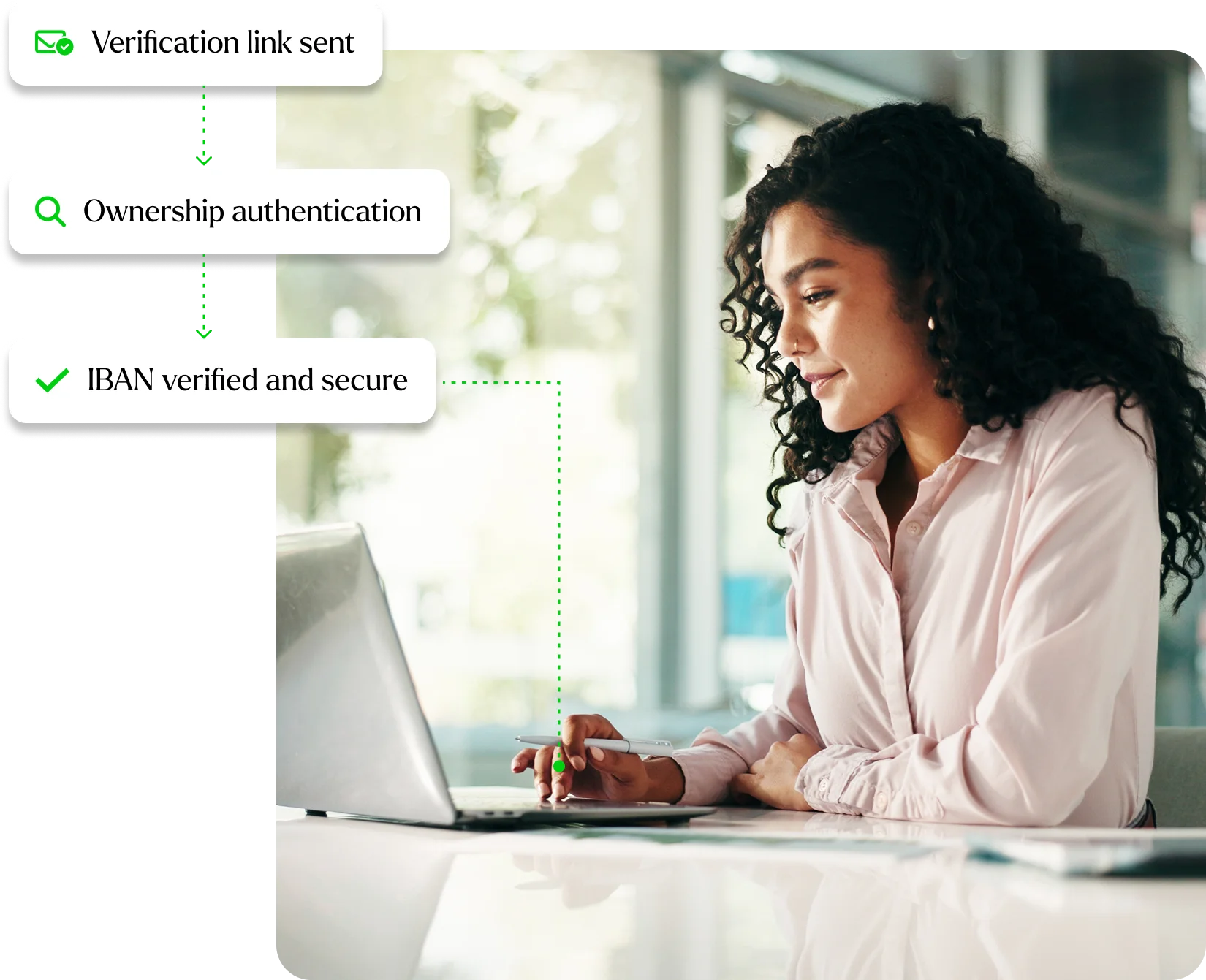

IBANcheck sends a secure verification link

The user receives an email with a unique link to verify the IBAN and start the Open Banking flow.

The user completes a short Open Banking flow

The link opens a regulated Open Banking flow where the user authenticates with their bank. IBANcheck accesses account ownership data in a read-only way.

IBANcheck matches the data and returns a result

IBANcheck compares the bank's account holder details with the identity and IBAN captured during onboarding, and returns a clear result that can be stored with the user's record.

WHO IS IT FOR

Built for large-scale onboarding

For utility companies

Make sure every installation is backed by a real account.

For energy, gas, water, telecom and other utility companies:

- Verify that the IBAN belongs to the customer before installation or activation

- Reduce losses from installations + first weeks of service that never get paid

Result: fewer surprises on the first charge, and more onboarding costs recovered.

For temporary staffing agencies

Pay the right worker, on the right account

For temporary staffing / employment agencies managing large worker pools:

- Confirm that each IBAN really belongs to the worker you onboard

- Avoid misdirected or fraudulent payroll payouts

- Strengthen controls against identity abuse and tax/benefit irregularities

Result: cleaner payroll runs and fewer issues with workers, clients, and auditors.

SECURITY & PRIVACY

Secure by design, compliant by default

Verification is performed through regulated Open Banking flows

Read-only access only: IBANcheck cannot move money or change accounts

Banking credentials are never seen or stored by IBANcheck and remain strictly between the user and their bank.

Data minimisation: only the information needed to verify IBAN and account holder is processed

Designed to support GDPR requirements and internal audit needs

High-volume IBAN verification for utility companies and staffing agencies.

IBANcheck is priced based on verification volume and adapted to the specifics of each business.

Get in touch if you have any questions or would like to receive a pricing proposal.